The Single Strategy To Use For How to Claim the Employee Tax Retention Credit: Tips for Employers

The Employee Retention Tax Credit (ERTC) is a useful tax break made to aid services always keep workers on their pay-roll during the course of the COVID-19 pandemic. Having said that, to state this credit scores, you have to abide along with the IRS requirements. In this short article, we will definitely talk about how to keep certified with IRS guidelines when declaring an Employee Retention Tax Credit.

1. Determine Your Qualification

The first action in declaring an ERTC is calculating if your service is eligible. To train for the credit history, you must have experienced a significant decrease in disgusting proof of purchases or a complete or limited suspension of functions due to government orders related to COVID-19.

If your organization fulfills one of these standards, you can assert the ERTC for wages paid for between March 13th, 2020 and December 31st, 2021. I Found This Interesting of the credit scores is up to $7,000 every worker every one-fourth.

2. Recognize What Earnings Certify

Once you determine that your service is entitled for the ERTC, it's essential to recognize what earnings certify for the credit score. Only particular styles of remuneration are qualified for this tax obligation break.

Qualified wages consist of:

• Wages spent while your organization was partly or totally shut down due to government orders

• Wages paid for during a time period of substantial decrease in disgusting proof of purchases

• Health planning expenditures

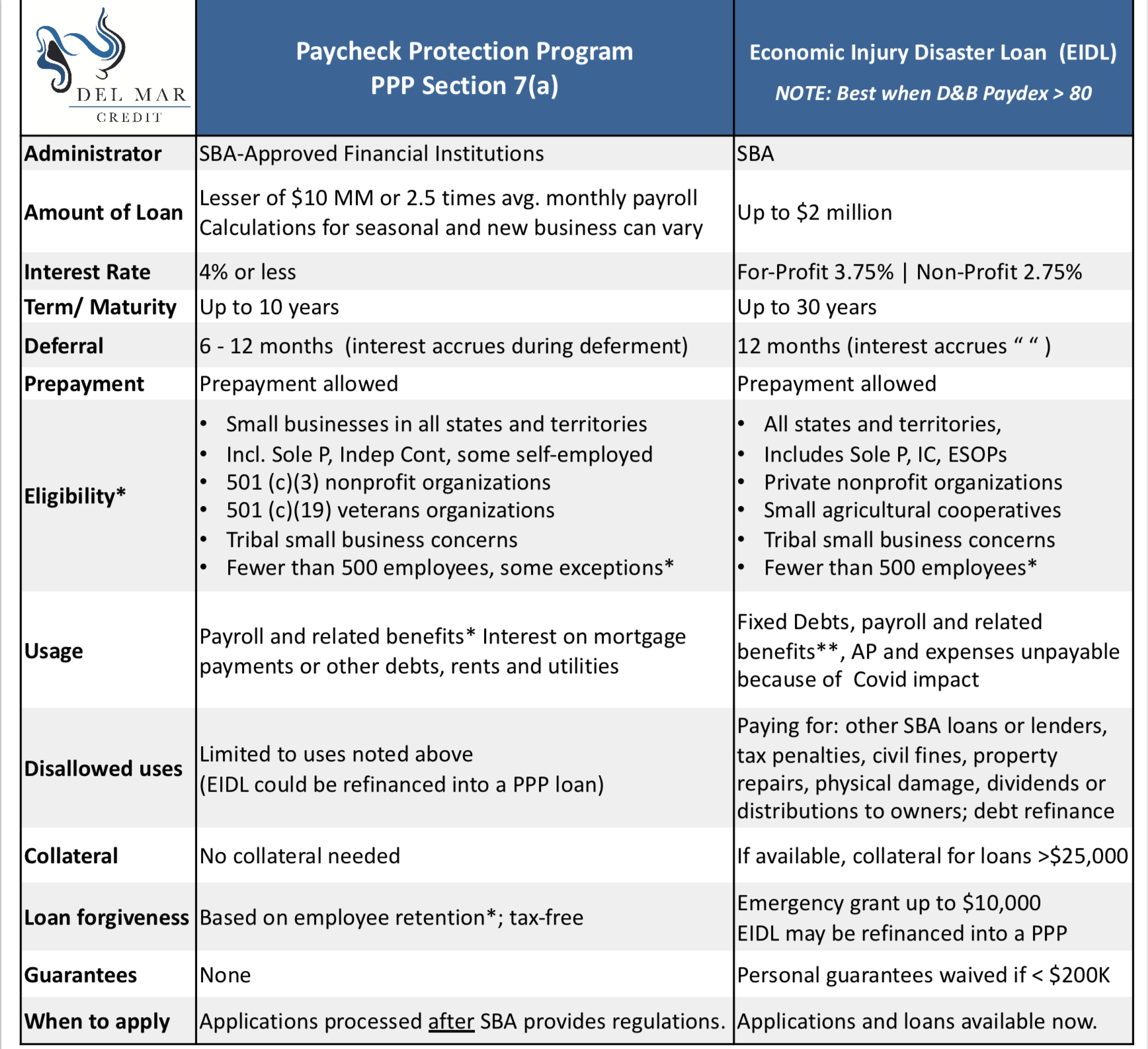

It's vital to keep in mind that qualified wages do not include any sort of amounts received from PPP fundings that were forgiven or urgent gives under the Economic Injury Disaster Loan (EIDL) plan.

3. Always keep Accurate Records

To claim an ERTC appropriately, you must maintain correct reports of all qualified earnings and wellness strategy expenditures paid out throughout the covered time period. It's also vital to maintain information showing how your organization was influenced through COVID-19 and why these expenditures train for the credit.

Without effective information and reports, it are going to be difficult to confirm any type of case produced on your income tax return if audited by the IRS.

4. Assert the Credit history Properly

To claim the ERTC, you must submit Form 941, Employer's Quarterly Federal Tax Return. On this form, you are going to state your qualified wages and compute your credit.

It's crucial to ensure that you state the credit history appropriately to avoid any kind of issues with the IRS. If you're doubtful regarding how to declare the credit report or have any type of concerns, it's finest to speak with with a tax obligation expert.

5. Be Mindful of Double-Dipping

One of the most important IRS rules when asserting an ERTC is staying clear of double-dipping. This suggests that you can easilynot assert both the ERTC and other COVID-19 comfort plans for the very same wages or expenditures.

For example, if you acquired a PPP lending and made use of those funds to pay out staff member wages during the course of a covered duration, those wages are not entitled for the ERTC.

6. Stay Up-to-Date on Improvements

The IRS has created numerous changes to the ERTC since its inception due to COVID-19. It's essential to remain up-to-date on any sort of new advice from the IRS concerning this income tax breather to guarantee observance.

Additionally, Congress may help make modifications that impact how companies may state this credit in potential regulations related to COVID-19 relief attempts.

In final thought, stating an Employee Retention Tax Credit can be a important tax rest for companies affected through COVID-19. Nonetheless, it's critical to comply with all IRS rules when stating this credit history effectively. Through understanding qualifications criteria, maintaining correct files and preventing double-dipping, companies may make certain observance while taking conveniences of this valuable tax obligation break during the course of these demanding times.